In this blog post, we delve into the latest developments regarding the EU’s Digital Services Act (DMA) and its impact on the online marketing landscape for hotels within the EU market. With Google’s recent insights revealing significant shifts in online traffic and interactions due to the DMA, the post explores the repercussions for hotels, particularly in terms of reduced direct bookings and increased reliance on intermediaries with higher commissions.

EU DMA’s Effect on Hotels: Google’s Insights Revealed

Picking up the thread of information related to the EU’s Digital Services Act (DMA), there are some important updates to understand how the online marketing of hotels with users from EU markets is evolving.

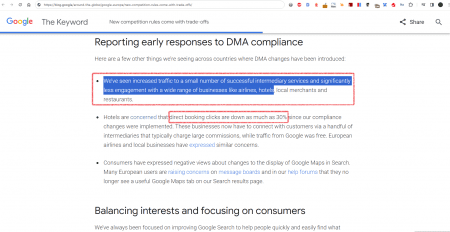

Last Friday, Google published a news item on its official blog reviewing the situation without sharing its own data from the hotel sector or any other industry to indicate that the measures taken are having negative effects and unintended consequences. Google points out that changes in the search results within the EU generate “more traffic towards a small number of successful intermediary services (in our sector OTAs) and significantly less interaction with numerous businesses from sectors like airlines, hotels, local commerce, and restaurants”.

Without offering its own data, which would be the most responsible way to explain what is happening to its customers and users, Google cites data from Mirai showing that clicks on direct hotel bookings via GHA have decreased by 30%, as well as now forcing hotels to deal with these intermediaries of higher commissions. It’s worth making an observation about this 30%: it is Google that should provide specific data since Mirai only talks about Google Hotel Ads (paid channels) omitting the SEO channel, whose impact we know is improved by an increase in impressions and more visibility of the Local SEO campaign. What we also see is that organic SEO is lower and loses qualified demand… at the same time as Google’s consent mode has been activated and that also makes it harder to understand what is happening.

In any case, the news that Google publishes should make us reflect: the changes of the DMA create a scenario overall worse than that of 2023 leading to a loss of qualified demand.

We share a screenshot of the Google blog post. We will continue to report on these important updates.

0